Financial Markets Lab

Lab Hours: Monday to Friday 9am - 6pm, Saturday 10am - 2pm

Objectives

Second, real-time data and analysis of historical data will support the creation and management of student-run investment funds. Presently, the there are two student-run investment funds: the Undergraduate Equity Fund and the graduate student-run Aztec Equity Fund (AEF). Past student managers of these funds have obtained positions in leading banking, financial services, and money management firms subsequent to graduation.

Third, the lab can provide students with skills that are increasingly required for careers in the finance and other industries. Bloomberg (and access to related databases) will enable interested students to acquire a Bloomberg certification and training on database platforms that improves their ability to obtain employment.

Finally, the Financial Markets Lab can be used to teach high school students the fundamentals of financial literacy, a vital knowledge to have for all members of society. faculty members, alumni and the external community wishing to schedule classes and/or special events: Please contact Edward Rey, Operations Director: [email protected]

Access to real-time data has allowed faculty to tailor their course offerings more directly to the real world. Numerous faculty from across the college’s five departments have gone through the training sessions, and the lab has been utilized for hosting a variety of undergraduate, graduate and special classes and seminars.

Testimonials by faculty, students, and alumni all point to the indispensable databases and unique information available at the lab, enabling users to conduct research, complete assignments and projects, and become exposed to many critical aspects of modern-day finance and economics.

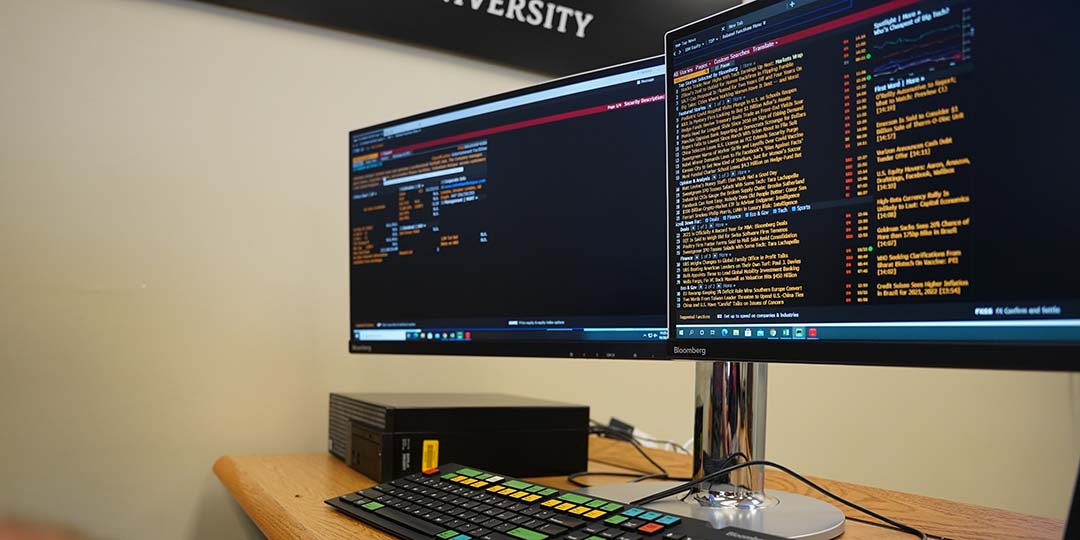

The Financial Markets Lab

Equipped with 12 Bloomberg Terminals, a stock market ticker display, and the latest classroom technology. With generous financial support and gifts provided by Stephen & Marjorie Cushman, the Financial Markets Lab was inaugurated on September 21, 2012.

Bloomberg Certification (BMC)

Effective Wednesday, August 31st 2016, the Bloomberg Essentials BESS GO function is replaced with the new Bloomberg Market Concepts BMC GO function.

BMC is an 8 hour self-paced e-learning course that provides a visual introduction to the financial markets. BMC consists of 4 modules – Economic Indicators, Currencies, Fixed Income and Equities – woven together from Bloomberg data, news, analytics and television. More information on the course modules and learning outcomes is available at BMC GO on the terminal. The full professor syllabus is available by typing BPS GOinto the terminal, clicking on “Audience Specific” then “Education” then “Bloomberg Market Concepts.”

Students have been particularly excited about the resume/CV-boosting certificate of completion and the signaling value that stems from adding BMC to the Certificates section of their LinkedIn profile. Additionally, BMC has built-in reporting functionality so that you can easily track how students performed on the 120 knowledge checks and case studies that are incorporated into the course.

Requirements for Certification:

Complete 5 out of 8 sessions offered by Bloomberg (available on the terminal in the Financial Markets Laboratory, 261 Love Library)

*4 core videos are required and then you can select one other Market Sector video

Core Videos (all 4 required)

- Getting Started

- Bloomberg News

- Market Monitors and Launchpad

- API

Market Sector Videos (select one)

- Equity Essentials

- Fixed Income Essentials

- Foreign Exchange (FX) Essentials

- Commodity Essentials

You must create your own Bloomberg user ID and login.

To Create A Personal Username and Password

- Launch Bloomberg

- Press the CONN DFLT key on the upper right of the keyboard

- When the username/password option appears, select the link to create a new user.

- You will be prompted to enter your name and create a username/password. Bloomberg must validate you before you can proceed. Choose how you want to receive your validation code: SMS Text Message is the preferred option using your mobile phone.

- Once you receive your validation code, enter it into Bloomberg; once it is successfully received, you may be prompted to complete a few additional informational questions.

- Each time you use Bloomberg to take a session, you will need to login using your personal username/password;

Watch Videos

- Type: B E S S GO in the upper left corner. This takes you to the online training program screen.

- Begin with 2) Getting Started to complete the 4 Core Videos.

Exams

- Enter B E S S GO; then select 6 GO

- You must make 75% or greater on each exam to pass.

Note: You are allowed to re-take exams once by contacting the Help Desk.

Tip: Take advantage of the dual-screen stations while taking the exam. It is highly recommended that you take the exam immediately after completing the video, rather than waiting.

Where do I complete the training?

On a Bloomberg Terminal located in Financial Markets Laboratory, Love Library 261.

Is there a charge?

The program is free of charge to SDSU students.

How long will it take to complete the program?

Approximately 5 hours total. Most videos last 30-40 minutes. Plan for 1 hour per video (the time to take the exam plus the time for the video).

How do I get started?

Create a personal username and password

Is there a time limit?

At this time, Bloomberg does not require that you complete the training program within a set timeframe.

How many questions are on each exam?

Each exam contains about 30 questions.

What score is required to pass an exam?

You must make 75% or higher on each exam to pass.

Can I retake an exam?

You may retake each exam one time.

What if I must leave while taking an exam?

The exam will be saved under your login, but it is recommended that you complete it within 24 hours.

How do I request my Acknowledgement of Completion certificate?

Type 6 GO from the Bloomberg Market Concepts menu.

All cheat sheets are in PDF format unless noted otherwise.

Derivatives Projects

- Options Cheat Sheet

- Futures Cheat Sheet

- Fixed-Income Derivatives Cheat Sheet

- Swaps Cheat Sheet

- Convertibles Cheat Sheet

- Risk Management Cheat Sheet

Equities Projects

- Equity Research & Analysis Cheat Sheet

- Company Earnings Cheat Sheet

- Economic Analysis Cheat Sheet

- Tracking Equities Cheat Sheet

- Technical Analysis Cheat Sheet

- Portfolio Analysis Cheat Sheet

Fixed Income Projects

Not a Finance Major? No Problem!

At the Financial Markets Laboratory, we believe that financial literacy is an essential skill for all students, regardless of their major. Whether you’re studying the humanities, sciences, or anything in between, our Lab offers a wealth of resources designed to enhance your understanding of finance and prepare you for real-world challenges.

We welcome all SDSU students to explore our dynamic learning environment. Our knowledgeable laboratory aides are always available to answer questions and assist newcomers in setting up their Bloomberg accounts. With hands-on training, you can gain valuable insights that will serve you well in any career path.

Staff

Emelia Engel

Michael May

Sasan Ahadian