Fowler Professors Share Their Findings on Gender Equity in Business

The third and final faculty colloquium for spring 2025 was held on April 25 with four Fowler professors sharing information about their research surrounding gender equity in business.

Open the image full screen.

Open the image full screen.

Molly Ahearne

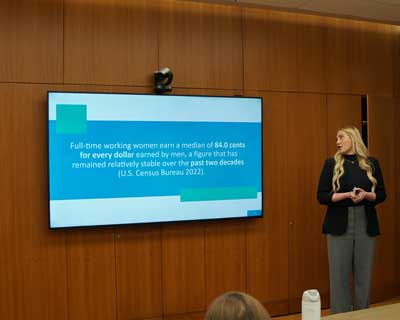

Marketing professor Molly Ahearne launched the event, sharing her findings about the gender pay gap. Her research showed how American women in sales make significantly less than men in the same roles, with an average total compensation gap of just over $7,000.

Ahearne demonstrated how the pay gap narrows when there is a higher share of female managers within the organization, and the organization has embraced diversity, equity and inclusion policies.

One profession lacking information regarding the pay differential between men and women is sales, noted Ahearne. “Sales employees make up approximately 10% of the U.S. workforce and it is a traditionally male-dominated industry,” said Ahearne. “It’s also a profession where there are clear measures for performance, but the research we have shows that even when women perform better than their male colleagues, men still earn higher salaries.”

Open the image full screen.

Open the image full screen.

Amanda Marino

Gender differences don’t just exist in salaries, but there is also a gender gap in the percentage of taxes paid by women. This is according to research conducted by accounting professor Amanda Marino, who noted that low-income individuals tend to pay a higher percentage of their incomes in taxes.

“This is because women and people of color tend to have lower-paying jobs, meaning that they pay more in income tax,” said Marino. “This also holds true with sales and excise taxes.”

Marino also pointed out that there wasn’t as much of a pay difference between men and women executives working in non-profit organizations (NPOs) as there was for executives working at for-profit companies, and there were also indications that women held more c-level management positions in NPOs.

Open the image full screen.

Open the image full screen.

Taekjin Shin

Taekjin Shin also discussed gender in c-level positions, focusing on how executives' experience in business school during their MBA program affects the hiring and promotion of women within an organization.

Shin says that the phenomenon of “imprinting” will often occur when students are pursuing their MBA.

“You know how baby ducks will attach to the first thing they see as their mother?” said Shin. “This is how imprinting works. It happens during a sensitive period in someone’s life and has long-term effects.”

Shin explained how MBA students may encounter increased emotional sensitivity while in business school since they are generally young, geographically isolated, but also experiencing intensive socialization and group identification. It’s also an environment where men and women have more equal roles during group projects and other interactions.

In his survey of 174 male CEOs, Shin found that those CEOs who earned MBAs in business schools with a greater number of female students also tended to be more likely to hire and promote women into management positions. However, this willingness to hire women managers may not last.

“We also found that imprinting decays over time,” said Shin. “This is also likely to affect hiring practices over a period of time.”

Open the image full screen.

Open the image full screen.

Ran Zhao

The performance of women CEOs and CFOs in the finance industry was the subject of Ran Zhao’s presentation. Zhao, a Fowler finance professor, explained that only 6.5% of his survey included women since there are so few women leaders in the industry.

Zhao also found a significant difference in the way men and women approached investments, with women favoring lower-risk investments (such as bonds) with lower returns, while men leaned toward more volatile investments (for example, stocks or commodities) that had a higher rate of return.

While women in c-level positions may have broken through the “glass ceiling,” they are also more likely to face a “glass cliff” according to Zhao.

“Women are more likely to be hired as top executives in firms that have recently been through some type of turmoil,” said Zhao. “Even though a female CEO or CFO may be able to get the firm back on solid footing, their conservative approach may upset investors or the firm’s board. When this happens, our findings indicate they are more likely to face termination — meaning the ‘glass cliff’ — than men in the same position.”